E-commerce VAT Guide (VATGEC1)

Recently, the FTA has published its new VAT Guide on E-commerce.

This document contains guidance about the VAT treatment of supplies of goods and services through electronic means, such as over the internet or a similar electronic network.

For the purpose of this guide, the UAE refers to the mainland UAE. This guide does not consider supplies of goods to, from or within Designated Zones. Such supplies are discussed separately in the Designated Zones VAT Guide | VATGDZ1.

What is e-commerce?

E-commerce (also known as “electronic commerce” or sometimes loosely referred to as the “digital economy”) generally refers to supplies of goods and services over the Internet or a similar electronic network, with goods and services being sourced or supplied by electronic means, such as through a computer, phone website or electronic applications.

This Guide discusses the following types of transactions:

- goods purchased through an electronic platform; and

- services supplied by electronic means.

Sales of Goods

For the purposes of this Guide, a supply of goods in the e-commerce context involves purchasing goods through an electronic platform, such as a website or a marketplace. Once the goods are purchased, they are then delivered to the recipient.

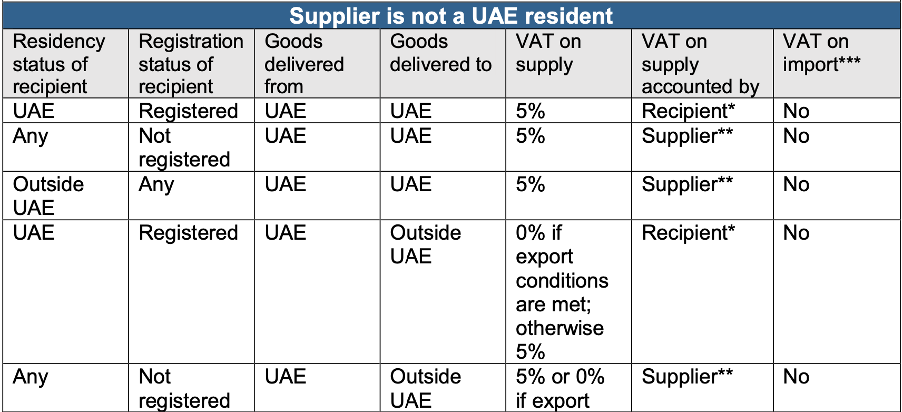

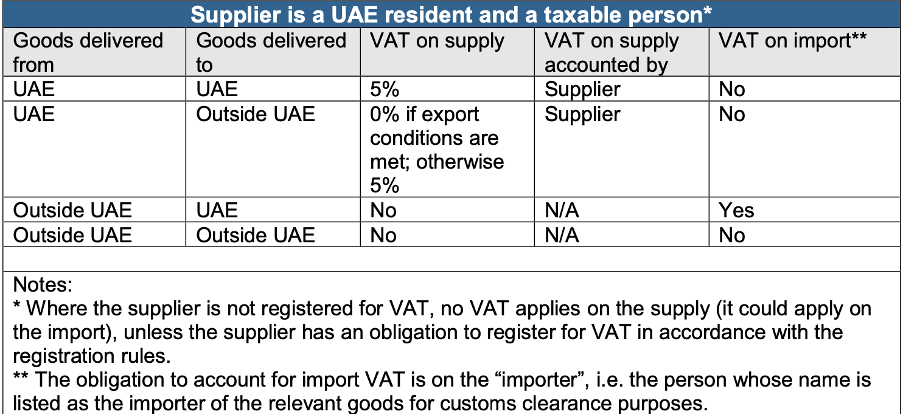

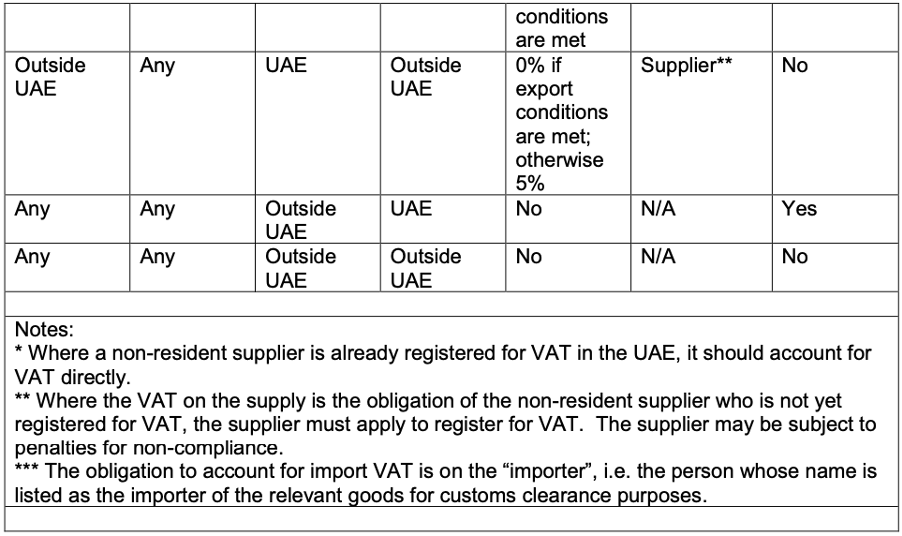

Depending on the location of the supplier, the recipient, and the goods, the supply may take any of the following basic forms:

- A supply by a resident supplier to a recipient in the UAE, with goods being delivered from either inside or outside the UAE;

- A supply by a resident supplier to a recipient outside the UAE, with goods being delivered from either inside or outside the UAE;

- A supply by a non-resident supplier to a recipient in the UAE, with goods being delivered from either inside or outside the UAE; and

- A supply by a non-resident supplier to a recipient outside the UAE, with goods being delivered from either inside or outside the UAE.

Supply of Services

For the purposes of VAT, “electronic services” mean services which are automatically delivered over the internet, an electronic network, or an electronic marketplace, including:

- supply of domain names, web-hosting and remote maintenance of programs and equipment;

- supply and updating of software;

- supply of images, text, and information provided electronically, such as photos, screensavers, electronic books and other digitised documents and files;

- supply of music, films and games on demand;

- supply of online magazines;

- supply of advertising space on a website and any rights associated with such advertising;

- supply of political, cultural, artistic, sporting, scientific, educational or entertainment broadcasts, including broadcasts of events;

- live streaming via the internet;

- supply of distance learning; and

- services of an equivalent type which have a similar purpose and function.

For a supply to fall under the special VAT rules for electronic services, the supply must, therefore, meet two conditions:

- the service in question must be one of the services mentioned in the above list of services; and

- the service must be automatically delivered over the internet, an electronic network, or an electronic marketplace.

The first of these requirements means that a service will not be an electronic service where it is not one of the services listed above, even if the service is supplied using the internet or an electronic network. For example, a supply of legal or financial advice, transport services, or hotel accommodation will not constitute an electronic service simply because the parties use the internet to communicate with each other or to facilitate bookings.

The second requirement means that an electronic service should be automatically delivered over the internet, an electronic network, or an electronic marketplace with minimal or no human intervention. Thus, although a small degree of human intervention is acceptable to enable or complete a supply, this intervention should not change the nature of the delivery of a service as being essentially automated. For example, where a recipient receives a manually generated email with a download link for the software which he has picked from the supplier’s website, the software can be still considered automatically delivered – the human intervention of sending an email with a download link is too insignificant to change the nature of the supply.

The above example can be contrasted with a situation where a recipient commissions customised software which has to be developed by the supplier before being put on the supplier’s website to be available to the recipient. In this situation, the human involvement from the supplier in developing the software is critical to the supplier’s ability to make the supply of services. As a consequence, the services cannot be treated as automatically delivered to the recipient.

It should be noted that a supply of electronic services may be made through an electronic marketplace rather than directly by the supplier to the recipient. “Electronic marketplace” means a distribution service which is operated by electronic means, including by a website, internet portal, gateway, store, or distribution platform, and meets both of the following conditions:

- it allows suppliers to make supplies of electronic services to recipients; and

- the supplies made by the marketplace must be made by electronic means.

Where a supplier makes a supply of electronic services through an electronic marketplace, and the electronic marketplace is not acting in a capacity as an undisclosed agent, then the supply is treated as made by the principal supplier directly to the recipient of the supply. On the other hand, where the electronic marketplace acts as an undisclosed agent for the principal supplier, there will be two supplies for VAT purposes – a supply by the principal supplier to the marketplace and the supply by the marketplace to the principal recipient.

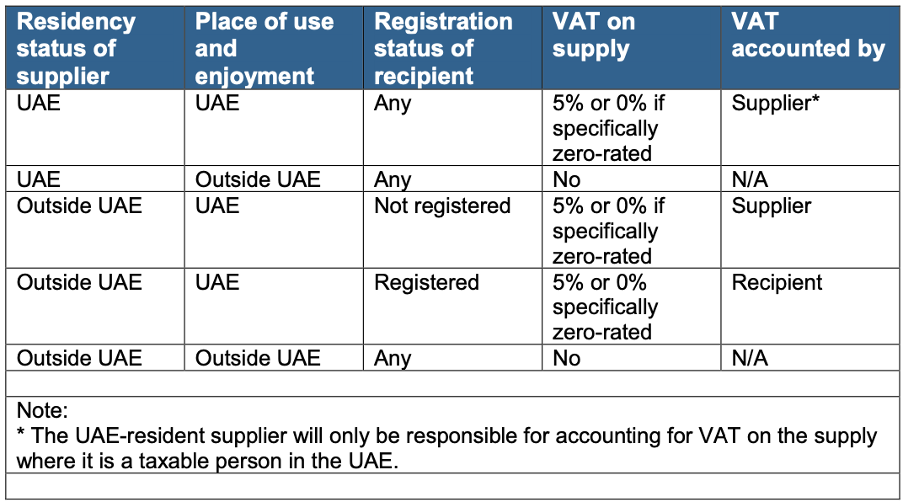

Place of supply of electronic services

Supplies of electronic services (as well as of telecommunications services) are subject to a special place of supply rule. Thus, the place of supply of electronic services is:

- in the UAE, to the extent of the use and enjoyment of the supply in the UAE; and

- outside the UAE, to the extent of the use and enjoyment of the supply outside the UAE.

The reference to the “extent” in Article 31 indicates that a single supply may be apportioned for the purposes of a place of supply rules, so that it is treated as partly in the UAE and partly outside the UAE. This ability to apportion a supply is, however, limited to situations where a sufficient distinction exists between the different parts of the supply (i.e. services supplied) or consideration (amounts charged for such services) so as it is practical and reasonable to divide them.

The actual use and enjoyment of electronic services should be determined on the basis of where the electronic services are consumed by the recipient, regardless of the place of contract or payment. Since the legislation does not provide any express rule regarding the indicators which should be used to determine the place of use and enjoyment, this determination must be made on a case-by-case basis, and all of the facts of the supply must be considered.

Nevertheless, the following principles may be used as high-level guidance in determining the place of use and enjoyment in various scenarios:

- In the case of an electronic service which is delivered to a physical place, the place of use and enjoyment of that service is that physical place. For example, where electronic services content can be only accessed from a particular physical location, that location will be the place of use and enjoyment.

- In the case of electronic services provided on a portable device, the use and enjoyment may be determined on the basis of the recipient’s location at the time the services are supplied. For example, where music is electronically delivered to a recipient located in the UAE, the place of use and enjoyment will be the UAE.

For the purpose of determining the location of the recipient, some of the factors which may be indicative of the recipient’s location are:

o the internet protocol (“IP”) address of the device used by the recipient to receive the electronic service;

o the country code stored on the SIM card used by the recipient to receive the electronic service;

o the place of residence of the recipient;

o the billing address of the recipient; and / or

o the bank details used by the recipient for the payment.

In determining the location of the recipient, the supplier should give priority to the factors which give the most precise information regarding the actual place where the electronic services will be used and enjoyed. For example, if a KSA resident orders an on-demand film to be watched on a computer with an IP address in the UAE, the use and enjoyment of the film will be in the UAE.

Supplies made through agents

Where an electronic marketplace makes any supplies of goods or services in its capacity as a principal supplier (for example, it buys and then sells goods), then the electronic marketplace is treated as the supplier of those goods or services for VAT purposes. As a consequence, the electronic marketplace would be required to comply with the VAT rules and obligations which are typically applicable to suppliers of those goods or services.

Where an electronic marketplace is not acting as a principal supplier of goods or services, it may act as an intermediary which enables a sale of goods and services. For example, an electronic marketplace may be used to advertise products, make bookings, process payments, and arrange deliveries of goods and services.

The VAT treatment of supplies using intermediaries will depend on the arrangement between the supplier, the intermediary and the recipient of the supply:

- Where the intermediary is acting as a disclosed agent between the supplier and the recipient of the supply, then the supply is treated as made directly by the supplier to the recipient.

Where an agent is charging an agency fee or commission for its agency services, these agency services should be treated as a separate supply of services from the supply of the underlying goods or services.

Where the place of supply of such agency services is in the UAE, the services are considered a taxable supply. It should be noted that the place of supply for agency services provided by agents must be determined independently from the place of supply of the underlying goods and services, and therefore can differ from the place of supply of such goods or services. For example, where a UAE agent provides agency services to a UAE supplier of electronic services which have a place of supply in the USA under the use and enjoyment rules, the place of supply of the agency services would still be in the UAE.

It should be noted that where an agent does not charge a fee or commission for its services, VAT would not be applicable on the services.

- Where the intermediary is acting as an undisclosed agent between the supplier and the recipient of the supply, then there are two supplies for VAT purposes – from the supplier to the intermediary, and from the intermediary to the recipient.

Where an undisclosed agent is involved in a supply of any goods or services, there are two simultaneous supplies of these goods or services for VAT purposes – a supply from the principal supplier to the undisclosed agent, and a supply from the undisclosed agent to the recipient of the supply. In effect, the undisclosed agent is treated as both the buyer and the seller of the goods or services.

The simultaneous supplies means that both the principal supplier and the undisclosed agent must separately charge VAT applicable on the supply of the underlying goods or services, and must account for this VAT to the FTA in their own VAT returns. Where it is eligible under the general input tax recovery rules, the undisclosed agent may also recover the VAT which was charged to it by the principal supplier – this ensures that this VAT is not a cost to the agent. Where an undisclosed agent and the principal agree that the agent can charge a separate agency fee or commission for the agency services to the principal, the agent must consider the VAT treatment of this services separately from the VAT treatment of the underlying supply of goods or services. Where the agent is able to embed the fee as a mark-up to the sale price of the goods or services, then the VAT treatment of the agency services should follow the VAT treatment of the underlying goods or services.

Tax Invoice Requirements

A VAT-registered supplier of a taxable supply of goods or services is required to issue an original tax invoice and deliver it to the recipient of the supply. This condition applies irrespective of whether the goods are sold directly or through an electronic marketplace.

As an exception to the default rule, where a VAT-registered agent makes a supply of goods or services on behalf of a principal, the agent may issue a tax invoice in relation to that supply as if that agent had made the supply.

A tax invoice issued by the agent must contain all the usual particulars required under Article 59 of the Executive Regulation, but may include the agent’s, rather than the supplier’s, details – in which case, the invoice should, however, contain a reference to the principal supplier (including the supplier’s name and TRN) somewhere on the invoice.

Only one tax invoice may be issued for any supply of goods or services. Therefore, this option is not available where the principal supplier has already issued a tax invoice. Similarly, where an agent has issued a tax invoice in respect of a supply made by the principal, the agent must ensure that the principal receives a copy of that tax invoice, and the principal should not issue its own tax invoice in respect of the same supply.

It is important to note that where the invoice is issued by the agent, the supply is still treated as being made by the principal supplier to the recipient of the supply. As a consequence, the supplier has to account for the relevant VAT and must comply with all the record-keeping requirements in respect of the supply.

Finally, it should be noted that where an agent is an undisclosed agent which is treated as making the supply under Article 9(2) of the Decree-Law, the undisclosed agent has the responsibility to issue a tax invoice in its own name.